All provinces and territories in Canada follow their employment standards legislation to regulate employment. Federally regulated industries, such as banks, railways, postal and courier services, etc., are regulated by the Canada Labour Code (CLC).

What is the Alberta Employment Standards Code?

The Alberta Employment Standards Code is the legislation that regulates employment in the province. It sets down the minimum standards for basic conditions of employment, including minimum wage, hours of work, overtime, leaves of absence, termination notice and pay. The ESC also outlines the legal rights and responsibilities of employers and employees.

The minimum standards defined in the Alberta Employment Standards Code apply to all provincially regulated workplaces even if employers don’t include them in their employment contracts. They cannot be ignored. However, these Alberta labour standards are a basic minimum. If employers wish to, they can offer higher wages or more benefits to their employees.

Who is not covered by the Alberta Employment Standards Code?

Though the Alberta Employment Standards Code applies to most employers and employees, there are some exceptions. The ESC does not cover employees working in federally regulated industries and self-employed workers and contractors. Also exempted from all Alberta labour standards are volunteers, family members, and farm and ranch workers employed on small farms.

There are special provisions to the rules outlined in the Alberta Employment Standards Code for ambulance attendants, caregivers, construction workers, domestic employees, firefighters, teachers, taxicab drivers, salespersons & direct sellers, etc.

Though municipal police service employees are governed by the Police Act, provisions relating to maternity and parental leave, reservist leave, or compassionate care leave still apply to them. Please refer to the ESC to check if your profession is covered by the legislation.

What are some major areas of employment covered under the Alberta Employment Standards Code?

Some important employment standards set down by the Alberta ESC are:

Minimum wage

Minimum wage is the lowest wage an employer can pay their staff. While they are free to pay more, employers cannot pay employees less than the Alberta minimum wage.

The general minimum wage in Alberta is $15/hour. The Alberta minimum wage for students under 18 is $13/hour for the first 28 hours worked in a week when school is in session. But if students work more than 28 hours in a week, they must be paid the general minimum wage of $15/hour for extra hours worked.

Some professionals are entitled to a weekly minimum wage of $598/week. These include salespersons, land agents and professionals, such as architects, accountants, dentists, lawyers, engineers, etc.

Domestic employees who live in their employer’s home must received a monthly minimum wage of $2,848/month. Domestic employees who don’t live in their employer’s home are entitled to a minimum wage of $15 per hour.

Three-hour minimum rule

Employees must be paid the minimum wage for at least three hours of work if the employer asks them to report to work or come into work for a short period. The only scenario in which the rule would not apply would be if the employee is not available to work the full three hours.

The three-hour minimum rule applies even if an employee works for fewer than three hours. If the employee’s regular wage is more than the general minimum wage, they must be paid their regular wage for less than three hours of work.

Two-hour minimum rule

Employers are required to pay some employees minimum compensation for at least two hours at not less than minimum wage. These employees include school bus drivers, home care workers, part-time workers at a non-profit recreation or athletic program, and adolescents who work on a school day.

Allowable deductions

Employers, with the written consent of their staff, can deduct the cost of meals and lodging from their employee’s minimum wage – up to a maximum of $4.41 per day for lodging and $3.35 for each meal consumed by the employee.

No deductions are allowed for any costs associated with uniforms, including purchase, cleaning, and repair.

Are any occupations exempt from minimum wage standards?

Yes. Some employees are exempt from minimum wage standards. These are:

- Real estate brokers

- Municipal police service members

- Post-secondary academic staff

- Securities salespersons

- Insurance salespersons paid entirely by commission

- Students participating in a work experience program approved by the Alberta government

- Students in an off-campus education program provided under the Education Act

- Extras in a film or video production

- Counsellors or instructors at a non-profit educational or recreational camp for children, handicapped individuals, or religious groups

General holidays

Alberta has nine statutory holidays:

- New Year’s Day

- Alberta Family Day

- Good Friday

- Victoria Day

- Canada Day

- Labour Day

- Thanksgiving Day

- Remembrance Day

- Christmas Day

There are four optional public holidays – Easter Monday, Heritage Day, Boxing Day, and National Day for Truth and Reconciliation – that Alberta employers can provide to their employees. But they are not obligated to do so.

Are all employees entitled to statutory holiday pay?

Most employees in Alberta qualify for stat holiday pay if they:

- Have worked for the same employer for at least 30 workdays in the 12 months prior to the holiday

- Work their last scheduled workday before the statutory holiday and their next scheduled workday immediately after the statutory holiday (unless employer consent is given for the absence)

- Work on the stat holiday if they are required and scheduled to do so

How is stat holiday pay calculated in Alberta?

Employees who don’t work on a statutory holiday receive their average daily wage if the holiday falls on a regular day of work. Employees who work on a public holiday are entitled to either:

- Pay of 1.5 times what they would normally earn for the hours worked in addition to an amount that is their average daily wage, or

- Their standard wage rate for hours worked on the general holiday plus a day off at a future date and an amount that is their average daily wage for that day off.

But if the holiday falls on a non-regular day of work and an employee doesn’t work on the holiday, they are not entitled to stat holiday pay.

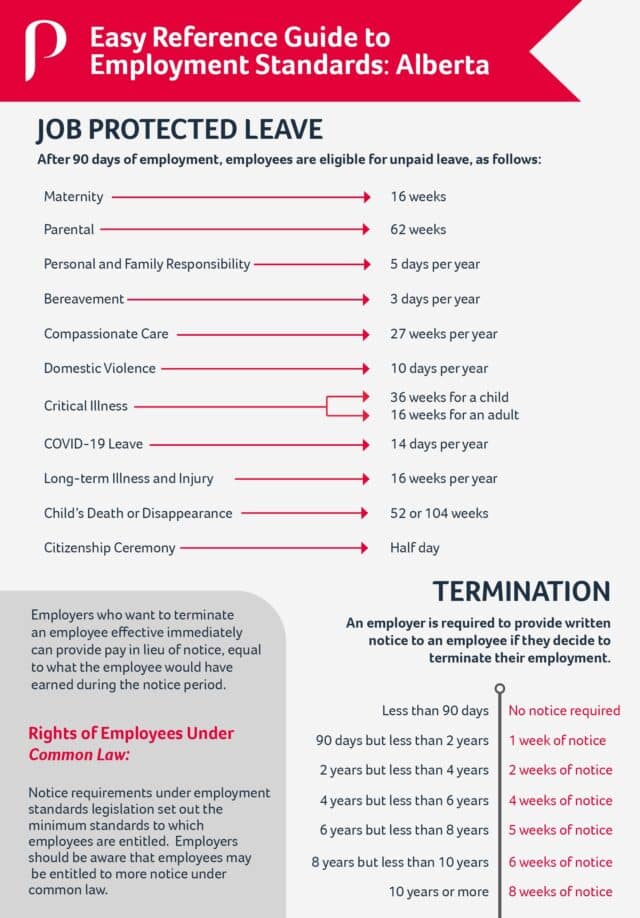

Job-protected leaves of absence

There are 12 unpaid, job-protected leaves of absence that employees are entitled to under the Alberta Employment Standards Code. These are:

- Personal and family responsibility leave

- Maternity and parental leave

- Citizenship ceremony leave

- Compassionate care leave

- Critical illness leave

- Bereavement leave

- COVID-19 vaccination leave

- COVID-19 leave

- Domestic violence leave

- Death or disappearance of child leave

- Long-term illness and injury leave

- Reservist leave

How many sick days do you get in Alberta?

If an employee is sick and needs to take leave, they can utilize the five-day personal and family responsibility leave.

Personal and family responsibility leave

Employees may avail this five-day leave for reasons of their health or to fulfill their family responsibilities in relation to a family member.

Please note that as of March 17, 2020, the personal and family responsibility leave has been extended to a “job-protected leave for a period of time that is necessary to meet the employee’s family responsibilities, if they need to care for self-isolated family members or children who are unable to attend school or child care services as a result of any recommendations or directions of the Chief Medical Officer with respect to COVID-19”.

Citizenship ceremony leave

Eligible employees can avail of this leave once when they acquire Canadian citizenship. On providing the employer reasonable notice, employees can take up to a half-day of citizenship ceremony leave.

Reservist leave

Employees who are reservists are eligible for this leave if they have been employed at least 12 consecutive weeks with the same employer.

An employee may take reservist leave for the following operations:

- Deployment to a Canadian forces operation outside Canada

- Deployment to a Canadian forces operation inside Canada that is assisting with an emergency or the aftermath of an emergency

- Annual training, included related travel time, for up to 20 days every calendar year

- Other operations as outlined as such in the Employment Standards Regulation

- Participation in pre- or post-deployment activities with regard to an operation is also considered part of deployment for the operation.

Periods of leave do not have to be consecutive. Eligible employees can take the leave for as long as necessary to accommodate the period of service required for international or domestic deployment.

Employers are allowed to request for proof of the employee’s eligibility for this leave. Employees must also comply with specific notice requirements in connection with notifying the employer when starting and ending the leave.

Domestic violence leave

Employees eligible for this leave may take up to 10 days of leave each calendar year. Employees are eligible for the leave if an act of domestic violence occurs to the employee, their dependent child, or a protected adult (under guardianship) living with the employee.

Long-term illness and injury leave

Eligible employees can take up to 16 weeks of leave due to illness, injury, or quarantine.

Critical illness leave

Eligible employees can take this leave to provide care and support to a child or family member.

Compassionate care leave

Eligible employees can take up to 27 weeks of leave to care for a gravely ill family member, who is at a major risk of dying within 26 weeks.

Bereavement leave

This is a three-day leave that can be taken after the death of an immediate or extended family member.

Death or disappearance of child leave

An employee is entitled to this leave if they are the parent of a child (under 18) who has disappeared as the result of a crime or who has died as a result of a crime. The length of the leave available is up to 52 weeks if the child has disappeared, and up to 104 weeks if the child has died.

COVID-19 leave

This leave entitles eligible employees who are in quarantine to 14 days of unpaid time off. This leave can be taken more than once.

Paid COVID-19 vaccination leave

Employees are eligible for this paid, job-protected leave (for up to three hours) to get the COVID-19 vaccine, including booster shots.

Maternity and parental leave

Eligible employees can take maternity (16 weeks) and/or parental leave (62 weeks) after a birth or adoption.

All employees are eligible to take any of these leaves if they have been employed at least 90 days with the same employer. Employers are not required to pay wages to employees while on any of the above-mentioned leaves (except for the paid COVID-19 vaccination leave). For all leaves, the Alberta Employment Standards Code only requires employers to provide the time off and allow employees to return to their job when the leave has ended.

Unless agreed to in an employment contract or collective agreement, employers aren’t required to pay wages or benefits during leave.

Employees availing these leaves are considered to be continuously employed, for the purposes of calculating years of employment.

Have questions about staying compliant with labour laws in Alberta?

Call our experts for free HR advice tailored to your business needs. Talk to an expert today at 1 (833) 247-3652.

Overtime

What is the 8/44 rule?

Most employees in Alberta are entitled to overtime pay though certain industries and professions are exempted. Overtime in Alberta is time worked in excess of eight hours a day or 44 hours a week, whichever is greater. This is called the 8/44 rule.

Overtime pay

An employer must pay an employee overtime pay of at least 1.5 times the worker’s regular wage rate for all overtime hours worked. This would not apply in cases where there is a written overtime agreement.

Employers and employees may also enter an agreement to bank overtime. In this case, the employer may give an employee time off work with pay (banked overtime). This would be at a rate of at least one hour for each overtime hour worked. Unless a collective agreement allows the overtime banking period to be extended, employees must use the banked overtime within six months of the end of the pay period in which they accumulated it.

Temporary layoffs

The duration of a temporary layoff in Alberta is normally 90 days in a 120 consecutive day period. For temporary layoffs related to COVID-19, the duration is extended to 180 consecutive days from the initial layoff date.

An employer is required to provide a written notice of temporary layoff before laying off the employee. To be valid, the notice must mention that it’s a temporary layoff notice and its effective date. It should include sections 62-64 of the ESC. In the absence of a proper temporary layoff notice, the employee may have been unjustly or constructively dismissed.

Though some courts in Alberta have also held that while the ESC allows an employer to temporarily lay off an employee in the absence of a collective agreement or contractual right, the employee still has the right to sue for constructive or wrongful dismissal if laid off in those circumstances.

To recall employees to work after a temporary layoff, an employer must serve a recall notice to the employee. A valid recall notice must be in writing and state the employee must return to work within seven days from the date the notice was sent to the employee.

How to serve a recall notice?

An employer can serve a recall notice in many ways. They give the notice to the employee in person, either at work or at the employee’s residence or leave the notice at the employee’s residence with a person who appears to be 18 or older. Employers can also send the notice by mail or registered mail or using fax or email.

If an employee does not return to work within seven days of being served the recall notice, the employer can terminate employment and the employee would not be entitled to termination notice or termination pay.

What is considered job abandonment in Alberta?

If an employee does not respond to a recall notice, it is considered to be job abandonment. However, employers should make numerous attempts before it can be deemed job abandonment (since in that case the employee would be deprived of their ESC notice). We recommend sending around three-four recall notices to ensure the employee has had a chance to respond. The employer should also document any calls/other attempts to reach the employee as additional proof that they made all reasonable attempts to notify the employee about the recall notice.

Termination of employment

Both employers and employees are required to provide each other notice to end the employment.

An employer can end the employment by providing an employee a termination notice, termination pay, or a combination of termination notice and termination pay. But if the period of employment is 90 days or less, neither party is required to give any notice.

The length of the notice period depends on the length of the service. Employees who have worked for an employer for more than 90 days but less than two years, must provide a week’s notice. If the length of employment is two years or more, the notice period increases to two weeks.

For employers, the notice period requirements are as follows:

| Length of employment | Notice period |

| More than 90 days but less than 2 years | One week |

| 2 years but less than 4 years | Two weeks |

| 4 years but less than 6 years | Four weeks |

| 6 years but less than 8 years | Five weeks |

| 8 years but less than 10 years | Six weeks |

| 10 years or more | Eight weeks |

What is the time period within which employers in Alberta must pay employees after termination?

The employer must pay the employee’s earnings with 10 days after the end of the pay period in which the employee was terminated, or 31 consecutive days after the last day of employment.

The employer cannot reduce the employee’s pay or other terms of employment during the notice period. They cannot require employees to use entitlements such as vacation or overtime during the termination notice period, unless both employer and employee consent to it.

Vacation time and pay

Employees have to work for an employer for one year before they are entitled to vacation time. Based on length of service, employers have to give annual vacation to most employees.

What is the minimum entitlement for paid vacation?

Employees must receive two weeks’ paid vacation after each of the first four years of employment. The entitlement increases to three weeks with pay after five consecutive years of employment.

What are the Alberta labour laws on youth employment?

The Alberta Employment Standards Code sets restrictions on the types of jobs people under 18 years of age can perform. While some jobs for those under 14 may require a government permit, parent or guardian consent is needed for all jobs.

Employees aged 13 to 14 may be employed in the following jobs without a permit:

- clerk or messenger in an office or retail store

- delivery person for small goods and merchandise for a retail store

- delivering flyers, newspapers and handbills

- light janitorial work in offices

- tutoring or coaching for a recreational athletic club or association

- food service staff in a restaurant or other food establishment where food is prepared and served or sold

Employees between the ages of 15 to 17 may be employed in any type of work and do not require permits. But parent or guardian consent is required for working during hours restricted by the ESC for this age group. The minimum standards and rights provided to employees under the Alberta Employment Standards Code also apply to employees under 18.

What are the Alberta employment standards rules on deductions from employee earnings?

The Alberta Employment Standards Code allows for some legal deductions that must be listed on every employee’s pay statement. These are deductions:

- required by law (CPP contributions, EI premiums, etc.)

- made for recovery of overpayments due to payroll calculation error (to be done within six months of the said error)

- for recovery of vacation pay paid before the employee earned it

- authorized by a collective agreement or in writing by the employee (for dental plans, registered retirement savings plans, etc.)

What about deductions for meals and lodging?

With the employee’s written authorization, employers can deduct the following from the employee’s wages:

- $4.41 for each day the employer provides the employee with lodging

- $3.35 for each meal consumed by the employee

What deductions are not allowed under the Alberta Employment Standards Code?

Employers cannot make the following deductions under any circumstances:

- deductions from wages to pay for uniforms, including costs associated with purchasing, renting, repairing and cleaning the uniform; or

- deductions for faulty work, cash shortages or damage to or loss of property.

How do I contact Employment Standards in Alberta?

You can contact Employment Standards in Alberta by phone at 780-427-3731 or toll-free at 1-877-427-3731 between 8:15 am and 4:30 pm Monday to Friday. You can also submit your query online here.

Do you need help staying compliant with the Alberta Employment Standards Code?

Our experts can help you develop company policies and assist you with any HR, health & safety, and employee management advice you may need.

As a trusted HR and health & safety consulting company, Peninsula serves over 4,500 small businesses across Canada. Peninsula’s clients receive ongoing updates of their workplace documentation and policies as legislation changes. They also benefit from 24/7 employer HR advice and are supported by legal assistance.

To learn more about how our services can benefit your business, call an expert today at (833) 247-3652.

This article provides a brief overview of Alberta’s Employment Standards Code (ESC). It is not a legal document. For more details, please refer to the ESC.